Overview

In my early career, I worked in the Automotive industry. At that time Asset Performance Management was at best “sporadic”. There seemed to be a mindset that you only focus on an asset’s output once there has been a significant lost time event. Then a full inquest would be undertaken without any historical data to help identify the root cause of the problem or highlight any corrective actions

This approach could best be described as “reactive maintenance” and it drove instability in production, a lack of accountability, and varying levels of response. By not collecting asset performance data and not having the ability to visualize the data in real-time a culture of blame was created. There was no clear visibility and no understanding of the Value Chain. Downtime measurement and reporting systems were focused on individual ownership resulting in debates as to who owned the problem.

The first attempts by management at data collection, to measure asset uptime, downtime, and assets being blocked and starved, was very manual and not standardized. Even though small improvements were made there was no real way of understanding Constraints in the Value Stream. This data collection process was manual and slow. It was time-consuming to collate the information into a format that could be used to clearly understand the problems that needed to be resolved. Having everyone in the team agree caused frustration and wasted time debating the data’s authenticity.

Standardised Asset Performance Measurement

As the organization adapted through the introduction of Production Systems Management, it became apparent that a standardized asset performance measurement approach was critical to the success of the business. Standardized Asset Performance Measurement requires that the organization embrace a continuous improvement methodology to Asset Management and Performance Measurement Systems.

The standardization of Asset Performance Measurement allowed organizational Key Performance Indicators (KPIs) targets to be set. Therefore, allowing corrective action management through planned maintenance activities and quick change over opportunities became driven by breakdown data analysis. Through the process, I learned that measuring and understanding equipment efficiency is key to improving cost and output performance.

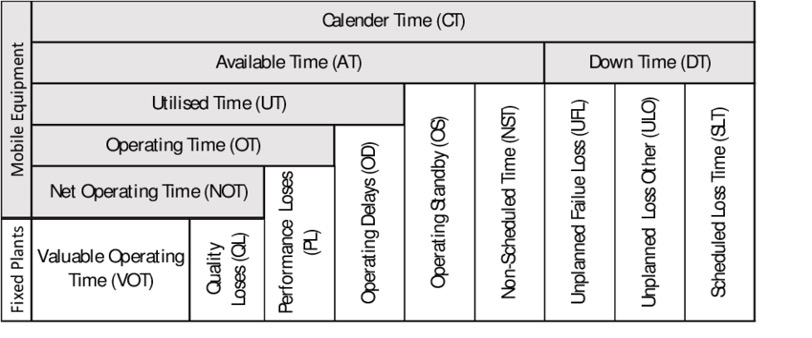

Today many organisations use standardised time models as a core component of their Production Management System. A typical example for both fixed and mobile equipment is shown in the diagram below.

This time model breaks down into categories all available time (Calendar Time) and then relates these time units to yield and costs. For example, production being driven by Net Operating Time (NOT), and standby cost being driven by Operating Standby (OS).

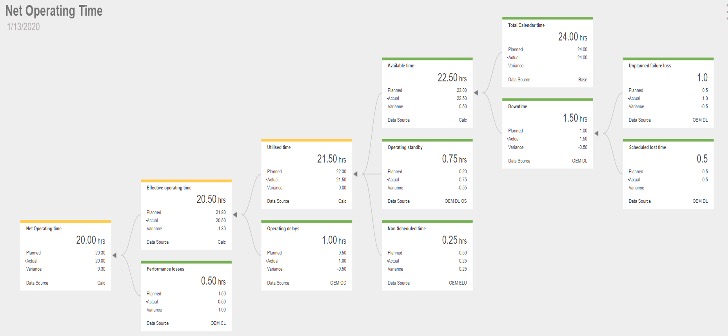

The Concerto software can model fixed and mobile asset time using a standard driver tree model, see below. For example, this model can be used to drive costs and production/yield for mining, manufacturing, and production equipment, as well as maintenance and transport equipment. The Concerto software also has the scenario modelling, dash-boarding and constraint modelling capability to find Productivity Improvement Opportunities and Benchmark Asset Performance.

Concerto models are available to support your organisation and kick start your Asset Management Performance. Please feel free to contact Concerto at info@concertoanalytics.com or if you would like a copy of the time model to add to your Concerto content library.

Authors:

Paul McLoughlin is a General Manager of Concerto with a strong focus on business improvement consultancy, he assists organisations to crystallise their strategy for operational, people, and analytics transformation. He has extensive experience working for Automotive giants such as Ford Performance Vehicles and Landrover UK.

Stephen Willams is co-owner and CEO of Concerto Analytics, a technology company that improves its clients’ business performance. His blogs cover a wide range of topics from software to organisational business dynamics and relationship management. He has extensive experience working in the mining sector delivering value driver models.

Stephen Willams is co-owner and CEO of Concerto Analytic